EVNi shares skyrocket following announcement of massive mineral resource in Ontario, Canada

03/08/2023 / By Belle Carter

EV Nickel (EVNi), a company that aims to develop zero-carbon nickel production, saw a surge in stocks after announcing a maiden mineral resource estimate (MRE) for the CarLang A Zone near its Shaw Dome project in Ontario. The company claimed the site has one of largest undeveloped nickel deposits in the world.

In April 2022, EVNi acquired the property located just over 15 miles southeast of Timmins. It immediately launched a diamond drilling program, which indicated resources of 1.25 million tons of contained nickel and inferred resources of 1.16 million tons of contained nickel.

“Defining this enormous maiden mineral resource for our Large Scale A Zone is a major milestone for EV Nickel,” said CEO Sean Samson. “The A Zone is just the beginning of the CarLang Area because we know the host units have been identified over approximately five times the strike length.”

He added that all must be considering the full potential of the CarLang Trend as this is the type of generational opportunity, which is near the surface and in an excellent location that the world needs for a supply of clean nickel to help fuel the energy transition.

As of Mar 3, EVNi’s share price was up 114.29 percent a share compared to the previous five days.

China is buying nickel from Russia’s largest miner using yuan

On the other side of the world, Russian nickel is now being traded using the Chinese currency yuan. The vast majority of global commodity trade is still based on global benchmark prices in dollars, but analysts are saying that this is another attempt to collapse the dollar.

Brazil, Russia, India, China and South Africa, collectively known as BRICS, have already coalesced in their efforts to give birth to a new currency and kill the petrodollar. (Related: BRICS member nations are creating new reserve currency to challenge the dollar, Andy Schectman tells Mike Adams.)

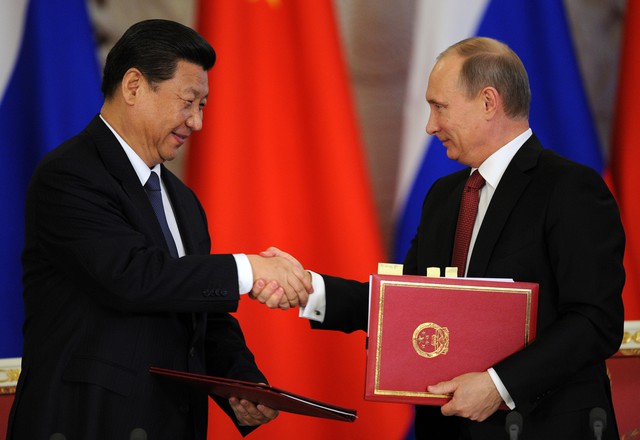

Norilsk Nickel (Nornickel), Russia’s number one nickel miner, is selling its metal in yuan at prices set in Shanghai. Bloomberg reported this as a sign of how the invasion of Ukraine is redrawing global commodity flows and handing greater power to China.

According to people familiar with the matter, Nornickel has sold some spot volumes to China using a mixture of London Metal Exchange (LME) and Shanghai Futures Exchange (SHFE) nickel prices and the volumes based on SHFE prices are being paid for in yuan.

The Russian miner, which supplies about seven percent of the world’s nickel, wanted to support the sales to China this year because European buyers are steering clear from Russian commodities. Also, negotiations over long-term contracts are ongoing for China, which is the world’s largest consumer of commodities.

While the West placed sanctions on the mining company’s top shareholder and president, Vladimir Putin, no penalties have been placed on the company itself or its exports. However, the invasion of Ukraine has led to disruptions in logistics, insurance, banking and shipping, putting pressure on Nornickel to accept its Chinese customers’ demands.

In January, Nornickel announced that it is likely to lower nickel output to up to five percent from last year’s level of 219,000 tons as it conducts maintenance that had been put off from last year due to equipment supply issues. The company is also restructuring logistics chains with a focus on more friendly countries, primarily China, Turkey, Morocco and Arab countries.

Nickel steel is used for armor plating and batteries, including rechargeable nickel-cadmium batteries and nickel-metal hydride batteries used in hybrid vehicles. Other nickel alloys are used in boat propeller shafts and turbine blades. The silvery-white lustrous metal has long been used in coins all around the globe.

Visit Metals.news for more news related to commodities and precious metals.

Watch this video as Health Ranger Mike Adams talks about the shutdowns of smelting operations for metals, including nickel.

This video is from the Health Ranger Report channel on Brighteon.com.

More related stories:

Aluminum and nickel, other commodity prices rise following Russia’s move on Ukraine.

Nickel market trading freeze and reversal of 5,000 trades proves that markets are RIGGED.

Sources include:

Submit a correction >>

Tagged Under:

BRICS, commodities, communist China, currency crash, EVNi, green deal, Green New Deal, green tyranny, LME, metals, NATO, nickel, Putin, Russia, shares and stocks, SHFE, west, yuan, zero carbon

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2022 RussiaReport.news

All content posted on this site is protected under Free Speech. RussiaReport.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. RussiaReport.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.